- Categories:

- Test Category

A global wealth management firm had recently gone through a merger and was looking to leverage post-merger opportunities and rationalize IT expenditure through platform streamlining programs.

Problems/Questions

The client was new to Expand and the CIO desired an understanding of the firm's competitive positioning with respect to IT intensity and costs, relative to peers that had similarly undergone merger activities.

How Expand helped

Expand performed detailed analysis of the firm’s entire technology cost and headcount data. It was identified that maintenance costs were significantly higher than for peers, and that clients ranked the firm's digital offerings as low relative to peers.

A deep dive diagnostic exposed that the firm had historically followed a very different service model, specifically around trade processing functions. While peers developed these technologies in-house, the client utilized a significantly more expensive third party service provider. Expand uncovered that this legacy setup had become prohibitively expensive as volumes had grown, due to the transaction-based nature of the arrangement.

Outcome

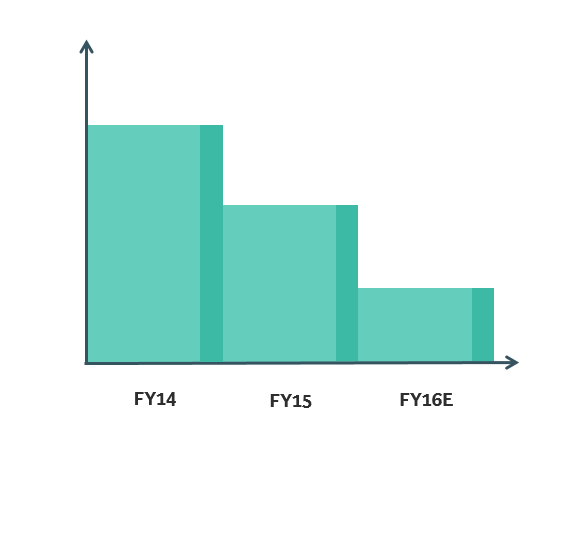

Expand presented the findings to the firm’s management committee in a series of 1-to-1 and workshop style debriefs, including a presentation to the CEO. Acting on the findings, the firm engaged with the Vendor Management team and set in place a program to shrink external costs over a 5-year period, and bring some of these capabilities in-house. This resulted in budget being freed up to be reinvested into the firm’s more strategic initiatives, such as tackling the firm’s sub-optimal digital client and adviser experience.